top of page

NEWS

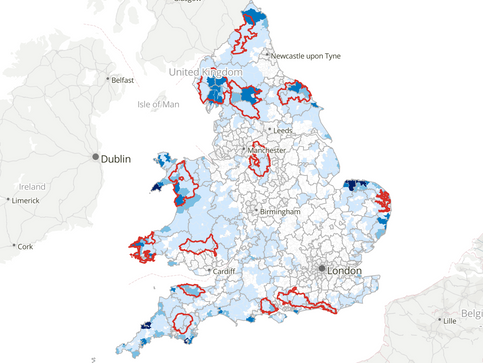

More than 1 in 10 addresses used as holiday homes in some areas of England and Wales

The Office for National Statistic (ONS) have share their analysis of 2021 Census data to reveal the hotspots where second addresses are...

Shepherd Partnership

Jun 21, 20231 min read

The digital pound consultation

Could there be a new form of money for households and businesses? HM Treasury and the Bank of England are consulting on a potential...

Shepherd Partnership

Jun 21, 20231 min read

Investing in Women Code closing the finance gap

The Government has published the third annual Investing in Women Code report. The Investing in Women Code is a commitment to supporting...

Shepherd Partnership

Jun 19, 20231 min read

Self Assessment threshold change

From tax year 2023 to 2024 onwards, the Self Assessment threshold for customers taxed through PAYE only, will change from £100,000 to...

Shepherd Partnership

Jun 15, 20231 min read

Extra time to boost your state pension by paying voluntary NI contributions

You now have until 5 April 2025 to pay voluntary national insurance (NI) contributions on gaps in your NI record between 2006 and 2016....

Shepherd Partnership

Jun 13, 20231 min read

Reasons you might benefit from having management accounts

Do you walk with your eyes closed or do you prefer to look where you are going? Do you wait until your annual accounts have been prepared...

Shepherd Partnership

Jun 13, 20232 min read

Small Business Saturday 2023

Small Business Saturday is once again highlighting 100 small businesses, one a day for 100 days leading up to Small Business Saturday...

Shepherd Partnership

Jun 11, 20231 min read

VAT 'Time to Pay' arrangements

A welcome change with VAT debts is that some businesses which owe less than £20,000 in VAT can now set up a time to pay arrangement...

Shepherd Partnership

Jun 7, 20231 min read

Happy news regarding our Managing Director, Adam Dutton

Adam Dutton, our MD, has been through a very difficult time of late, but we're very happy to be able to share a positive outcome with...

Shepherd Partnership

Jun 4, 20232 min read

Scam warning for tax credits customers

HMRC has issued a warning to those renewing their tax credits claims to be alert to scammers trying to steal their information. Tax...

Shepherd Partnership

Jun 2, 20231 min read

Tax-free Childcare

According to the latest statistics, Tax-Free Childcare has saved 649,935 families on childcare costs during the 2022 to 2023 tax year; an...

Shepherd Partnership

Jun 2, 20231 min read

Funding available for environmentally resilient farming solutions

A new post, “Funding available for environmentally resilient farming solutions” has just been published on the DEFRA's farming blog. If...

Shepherd Partnership

Jun 1, 20231 min read

National Minimum Wage rate reminder for those employing seasonal or summer staff

All workers are legally entitled to be paid the National Minimum Wage (NMW), including temporary or seasonal staff, who often work...

Shepherd Partnership

Jun 1, 20231 min read

Guidance for small business owners

Working in collaboration with the British Business Bank, Companies House has created articles to feature on two of their business...

Shepherd Partnership

Jun 1, 20231 min read

Farming: New £12.5 million R&D competition

Farmers and growers can now apply for the new competition for up to £1 million in project costs to drive the development of new...

Shepherd Partnership

May 31, 20231 min read

The tax benefit of gift aid donations

The gift aid scheme was introduced in October 1990. It enables charities to reclaim basic rate of Income Tax from HMRC on qualifying...

Shepherd Partnership

May 31, 20232 min read

Allowances for working from home

Many employees became eligible to claim a tax allowance for working from home during the Covid pandemic. However, since the Covid...

Shepherd Partnership

May 30, 20231 min read

Improvements to farming schemes for upland farmers

DEFRA recently announced changes that are being made, following feedback from upland farmers and industry representatives, to make their...

Shepherd Partnership

May 29, 20231 min read

Self Assessment threshold change

From tax year 2023 to 2024 onwards, the Self Assessment threshold for those taxed through PAYE only, will change from £100,000 to...

Shepherd Partnership

May 25, 20231 min read

How long should I keep my tax records?

We're often asked by our clients how long books and records should be kept. Here we have put together an overview of the rules. As you...

Shepherd Partnership

May 24, 20232 min read

bottom of page